The London Stock Exchange Group is the company that runs the stock exchange and financial information company for the UK, headquartered in London. Interestingly for spread betting and other traders, it is a very volatile index, varying between 900 and 1100 in the last two months alone.

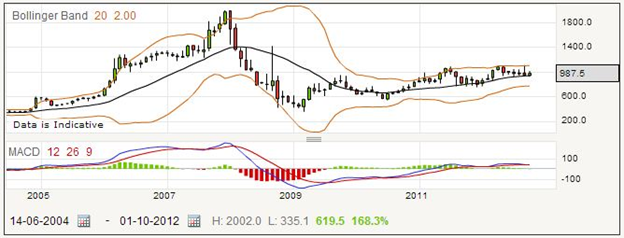

This monthly chart shows you the stock price progress over recent years. The company also owns the Italian stock market, called Borsa Italiana, which it bought in 2007. That was when it started calling itself a “Group”. It has only been listed on its own FTSE 250 Index (which is based on capitalization) since the middle of 2012.

The London Stock Exchange was originally formed in 1801. It moved to a new building and trading floor in Threadneedle Street, famously known as the street of the Bank of England, in 1972. The Alternative Investment Market (AIM) for smaller companies was introduced in 1995, and the Exchange moved again in 2004.

Recent happenings include the purchase of Millennium Information Technologies, a software company developing trading systems, in 2009, and the transfer to this low latency platform in 2011.

You can see from the chart that the price has fluctuated significantly since a partial recovery from the global economic crisis of 2008, and that it is still far from its previous level. The daily chart shows several gaps as well as long candles, and these suggest that you should be particularly cautious when spread betting on the stock price of the London Stock Exchange Group. As it is in a market sector which is sparsely populated, there is little track record on which to base future projections of the price moves.

Nonetheless, the charts can be relied upon to show the market sentiment of other traders, and technical analysis will point you in the right direction more often than not.

London Stock Exchange Group Rolling Daily: How to Spread Bet on LSE shares?

When you are spread betting on the London Stock Exchange Group (LSE.L), you need to be careful to avoid any large losses as the price tends to be volatile. The current rolling daily price is 984.0 – 989.0. If you think it is going down, you might place a sell bet for £10 per point.

For the sake of this example, assume that the price goes down as you expect, and you decide to close your bet when it reaches 916.5 – 921.5. You can work out how much you have won from the difference in points and the amount of your stake. Your bet was placed at 984.0, the selling price, and it closed at the buying price of 921.5. That means you gained 62.5 points. With a stake of £10 per point, that works out to £625.

Often the bet will not work out as you wish, so for a second example suppose that the price went up after you placed the bet, and you decided to close your trade for a loss when it reached 1036.2 – 1041.2. It is an important discipline to close a losing bet when necessary, rather than wait in hope to see if it “turns around”. Your bet was placed at 984.0, and this time you closed it at 1041.2. That means you lost 57.2 points, which equates to £572.

Finally, many traders decide to use a stop loss order to make sure that their losing bet is closed in a timely manner, whether or not they are able to access the markets. In this case a stoploss order might have closed your bet at 1012.6 – 1017.6. This would have saved some of your loss. With an opening price of 984.0, and the closing price of 1017.6, your loss would have been 33.6 points and would cost you £336.

London Stock Exchange Group Futures Based Spread Bet

If you want to take a longer view of the market, you may be interested in a futures style bet. The current quotation for a mid-quarter futures style bet on the London Stock Exchange Group, which expires five months from now, is 986.1 – 995.0. Let’s say that you believe the price is going up, and are prepared to bet £6.50 per point on this belief.

Perhaps you will be a winner. If the price goes up to 1059.7 – 1067.2, you could close your bet and collect. As a long bet, your starting price would be 995.0, and the closing price would be 1059.7. It is easy to remember which one of the pair of prices to use, as whether you win or lose it always works against you. Remember that your spread betting provider needs to gain the spread to pay for his services. 1059.7 minus 995.0 is 64.7 points, and multiplying it by £6.50 gives you a profit of £420.55.

If instead you are a loser, you may choose to close the bet when the price falls to 948.3 – 957.0. This time you have lost 995.0 less 948.3, which is 46.7 points. At £6.50 per point, your loss is £303.55.

As an alternative to watching the markets yourself, you could choose to place a stop loss order with your provider, which will close a losing bet for you with no further intervention. If you had used a stoploss order, you might find that you are out of the bet when the quote is 961.0 – 969.8. Your bet was placed at 995.0 as before, and your spread betting company closed it for you when it had fallen to 961.0. 995.0 minus 961.0 is 34.0 points. 34 times £6.50 is £221, which you would have lost on this bet.