The Volume Accumulation Indicator or VAI measures trading volume in relation to price fluctuations. In other words, if a market spends most of the trading day falling but ends on an upturn the positive trend should be regarded in relation to the overall picture, which is downward.

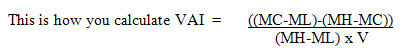

The calculation looks complicated, but is simpler than it appears because you can get all the information you need from the financial newspapers and many financial websites. It is a very good way of spotting the overall direction of a market when prices are fluctuating heavily, and a way of supporting your feeling to bet against the current direction of the market.

- MC is the market closing price.

- ML is the lowest price the market reaches.

- MH is the highest price the market reaches.

- V is the volume of trading during that period.

To use the VAI plot the figures for each day over any given period on a line chart. Also plot the current market closing price. Any prominent convergences and divergences are though to indicate a prominent reversal of the present market trend.