Important Notice – the top traders mentioned in this section of the guide have all developed their own trading methodology based on the principles of trend following. They are included to show you some of the success stories that trend followers have enjoyed for more than 20 years.

The following examples show trend following success dating back to the 1950’s.

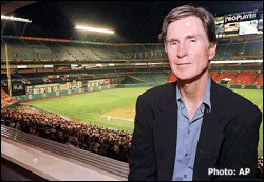

John W. Henry, owner of the Florida Marlins baseball team, is a legendary trader and a former farmer. He opened his first managed account with $16,000. Since then, John Henry has earned over $500 million dollars in his career trading as a trend follower.

John W Henry

“Some commentators have referred to the recession-inflation economic alternatives as a choice between fire and ice. As trend followers, we do not have to choose a forecast; we have to watch price movements. I don’t know which scenario is better, but if either extreme becomes reality, there will be some significant dislocations in price that may be good for our programs.”

William Eckhardt

“This is one of the few industries where you can still engineer a rags-to-riches story. Richard Dennis started out with only hundreds of dollars and ended up making hundreds of millions in less than two decades – that’s quite motivating.”

Ed Seykota.

Trading as a trend follower, Ed Seykota is famous for turning $5,000 into $15,000,000 over 12 years. That’s a 250,000% return. Seykota is one of the great trading teachers alive today, specialising in money management and psychology.

Jerry Parker hails from Lynchburg, Virginia and went on to become the largest of the original trend followers making well over $100 million dollars profit for himself by the age of 40. He founded Chesapeake Capital Corporation in 1988, offering investors the chance to profit from price trends not typically available through traditional portfolio strategies.

Jerry Parker

Richard Donchian is considered the father of trend following. Since the 1950’s, his students have gone on to earn millions in the marketplace. Donchian’s original trend following ideas formed the basis for all trend following success that have followed, including the famous Turtle trading strategies.

Richard Donchian

Donchian’s original methods involved the use of a moving average for the entry/exit indicator portion of his system.

Richard Dennis – Richard Dennis has a small and unobtrusive office. His company, ‘C&D Commodities, Richard J. Dennis and Company.’ is a trend following money manager. The humble office disguises the performance of an individual who, in his own estimate, made between $100 million and $200 million. It is well known that over a number of years, Richard Dennis traded an initial stake of $1,200 into $300,000,000. By many measures, he thereby achieved the greatest performance in the history of the markets.

Richard Dennis

“What you’re asking about [are] rates of return; what you can reasonably make. And I’ve found that my trading style with small amounts of money allows around a 300% return.”

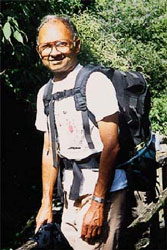

Dinesh Desai – was one of the best trend followers in the 1980s before he retired. Desai, a long-term trend-follower, ran California-based Desai and Co, from 1973 until his retirement in 1994. At his peak, he had $ 250 million under management and averaged 80% returns per year. In some years his returns were in excess of 100%. Today, Desai focuses on different kinds of peaks. He is an avid outdoor adventurer.

Dinesh Desai

Among his achievements, 59-year-old Desai walked the 1,100 mile California coastline, from Oregon to Mexico. And recently, he and three others went on a 200-mile hike in Death Valley, during July, when temperatures hit global highs.

Bill Dunn –Dunn has traded as a trend follower since the mid 1970’s. He is one of the few money managers who has managed to average the magic 25% return for 25 years. His net worth exceeds $200 million dollars. Dunn credits his success to trend trading. One of his trend following funds is up 7112% since

1974.

Bill Dunn

Dunn’s office is on a quiet street, within a retirement community. There is no receptionist to greet you when you enter his office. Your only recourse is to walk down a hallway to see if anyone is in. To say the least, the atmosphere is casual and laid back.

Dunn is most likely the truest trend follower in existence for a key reason. He trades the system full throttle. Dunn shoots for 100%+ returns. By shooting for big returns Dunn knows he will have drawdowns but he and his clients are psychologically prepared for them.

Bill Dunn has less than ten core clients. If you look back you will notice a curious situation at Dunn. Most money managers have additions and withdrawals of capital. These ins and outs of money flow are often not related to the trading itself.

Dunn is different because he compounds. By maintaining few clients Dunn has developed a dream fund. He leaves his money on the table by reinvesting in the fund. As a result, Dunn’s trading capital is not made up of recently added money, but rather his trading capital is the result of systematically reinvesting profits over a long time period. Instead of looking for a quick hit, Dunn’s’ clients keep a good portion of their profits in the market.

By focusing on profits, Dunn only makes money when the fund makes money. He doesn’t charge a management fee. With no management fee, there is no incentive to raise capital. The only incentive is to make money. If Dunn makes money he gets a portion of the profits.