Centamin Spread Betting

Egypt-focused gold producer Centamin (CEY) rose from a penny share quoted on Aim in 2001 with a market valuation of a few million to a £992.4 million company. The value lies in Centamin’s rights to extract gold from the Sukari mine for which it has invested over US$700 million in Egypt to date and an additional US$287 million to the Stage 4 expansion project since it started in 2011. The Sukari mine presently employs 1200 people, with a further 3000 employed indirectly.

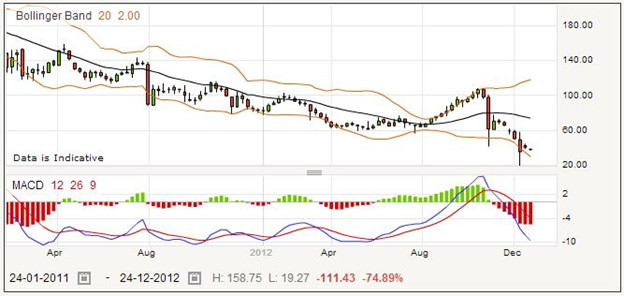

Centamin is a gold mining company, and works in Egypt. The weekly price chart below shows a general decline in its value, some of which is due to local circumstances, so when spread betting on this share you need to acquaint yourself with the advantages and limitations of this operation.

Background Centamin

The company started by being listed on the Australian Stock Exchange in 1970, and bought an Egyptian mining company in 1999, subsequently gaining a large lease for exploration in the east of Egypt. It took out a listing on the Toronto Stock Exchange in 2007, mainly so it could raise funding for production, and it started producing gold in 2009. In the same year, the company sought a full listing on the London Stock Exchange, and was subsequently delisted from the Australian Stock Exchange.

Despite this, the company’s headquarters are still listed as Western Australia, although the domicile of the company is now Jersey. The estimated production for 2010 was 150,000 ounces of gold, and in 2011 it produced 200,000 ounces of gold. Notwithstanding this, as you can see there is a regular decline in share value.

One of the reasons for this may be dealing with regulations abroad. For instance, in December 2012 the company received a claim for additional funds from their diesel fuel supplier, which also cut off their fuel supply until the claim was settled. The company also faced customs issues, despite claiming to have all necessary legal permissions. Such interferences are usually reflected in the company’s valuation.

Presently Sukari is Egypt’s only modern gold mining project but it is still a big producer by world standards. Centain produced some 150,000 ounces of gold at a cost of US$527 per ounce in 2010 and this increased to 200,000 ounces at US$556 per ounce in 2011. 2012′s output is geared to be around 250,000 ounces and the company is also working on its Phase 4 expansion project which would double plant capacity to 10 million tonnes per year.

It is thought that that the mining field has large reserves and there happens to be even more exploration upside in Sukari Hill and on the 160km2 tenement area around the hill. (Latest data put the current Sukari Ore reserves at 277 million tonnes in the ‘Proven and Probably category’ at a grade of 1.13 g/tonne for 10.1 million contained ounces of gold – calculated at a gold price of $1,100 an ounce. Out of these reserves, the open pittable segment makes up 266.6 million tonnes at 1.09 g/tonne, underground ore at 1.1 million tonnes grading 16.3 g/tonne and there is also surface stockpile material of 9.4 million tonnes at 0.57 g/tonne.

The weekly price pattern shows cyclical price variations, accompanied by MACD indications, and on a daily chart it is likely that these would be tradable. This makes the important point that you must always check the stock price on the various timescales, correlating the sales to see how you can expect the stock to perform in the future.

I’ve been weighing up spread betting both Afren and Centamin against each other. CEY certainly carries more risk due to its location and its single operation. Sure AFR is in risky areas but it is spread about a lot. Both companies are swinging from a cash burn in the recent past to cash generation very nicely over the next two years.

I tend to look at Centamin as where AFR were a year or so ago, as far as share price movement is concerned. AFR took a leap forward when Ebok came on stream and I think CEY will take a leap after their first results that don’t include the expenditure on the new plant. Check the recent results. They are currently spending a lot of cash on the plant but it is due for commissioning Quarter 1 next year. 2013 Q2 results will see considerable % increase in profits here if things continue progressing well – allowing for business regulatory stability in Egypt!

Good luck mate and remember the key is a balanced portfolio.

Note: This is a personal opinion and is not intended as advice to buy or sell either company!

Update: 30th October 2012: Centamin shares just dropped on an epic scale today. An Egyptian administrative court has just ruled that Centamin’s contract to exploit the Sukari gold mine in Egypt is void. This is the latest ruling by Egyptian courts that have challenged contracts granted under the rule of Hosni Mubarak, who was ousted in a mass uprising last year. Meanwhile, Centamin from its part emphasised that the Court doesn’t have jurisdiction to nullify the agreement and said that its working with the Egyptian Mineral Resource Authority (EMRA) and the Ministry of Petroleum to resolve the issue. I dare say this may recover somewhat, once the panic money has all left.

Centamin now also has a dispute with the Petroleum Ministry in respect to fuel subsidies which is now in the court. The dispute revolves around diesel fuel subsidies Centamin has received from December 2009 until January 2012 which the company has described as an illegal retrospective claim. Centamin appears to backed by the Egyptian Mineral Resources Authority (EMRA), although this doesn’t seem to have the overall power of the Petroleum Ministry. In any case excluding the fuel subsidy does somewhat increase the mine’s operating costs.

A big problem for CEY – But not insurmountable. There are courts within Egypt and honest people within the Court System and the Civil Service. It may be a long drawn out process. If the mine is closed then wages stop, and tax income stops. After exhausting the Egyptian system there are international trade courts and treaties. Eventually most countries want to demonstrate that they are honest and open for business. An open complex system of 80 million people cannot act on a whim. It is not as if it is a small ‘closed’ sheikhdom. There have been few cases where outright theft of licenses have been upheld. Compensation was awarded in DRC following legal action. Legal processes in Mozambique relating to Pathfinder are still progressing.

Having said that I think mining in emerging markets is becoming very high risk. Last week Kenya announced that all miners will now have to provide 35% equity to the local communities. CEY must surely appeal, and the Egyptian authorities will surely have time to review what is likely to happen if foreign capital and contracts are threatened in this way. This sort of thing will stop further investment by foreigners in all aspects of Egyptian economy. The market constantly throws up uncomfortable lessons, and this is just one more of them. Big risks, big movements present big opportunities… 😮 )

Spread Betting Centamin plc Rolling Daily

Despite the fact that the shares of Centamin appear to be in a steady decline, you must always perform technical analysis before you decide which way to trade. Assuming your analysis agrees, you may choose to place a short bet on these shares which are currently quoted at 36.91 – 37.09 on a daily rolling basis. Assume you stake £40 per point.

Perhaps the price goes down to 27.91 – 28.09, and you decide to close your bet and collect your winnings. Your sell bet opened at a price of 36.91, and closed at 28.09. Taking 28.09 away from 36.91, you would have gained 8.82 points. Simply multiply this by your stake of £40 per point, and you find that your overall profit is £352.08.

Should the market go the other way, you must close your bet for a loss before the price goes up any higher. Perhaps you ended the trade when the quote is 42.31 – 42.49, which means you have lost 42.49 minus 36.91 points, or 5.58 points. With a stake of £40 per point, this losing bet would cost you £223.20.

Many spread traders do not have time to watch the market all day long. They may have other jobs, or at least have other distractions that might make them miss a significant move, and suffer untoward losses. That is why the stop loss order is popular, as it takes you out of a losing position at a level you set, whether or not you are aware that the price has changed. In this case a stoploss order might have closed your short position when the price went to 39.61 – 39.79. Your opening price was 36.91, as before, and your closing price was 39.79, which is a difference of 2.88 points. For your chosen size of wager, this would amount to a loss of £115.20.

Spread Betting Centamin plc Futures

You might be interested in placing a futures style bet on the mining company Centamin, and the current price for the far quarter futures is 37.04 – 37.49. If you choose to place a sell bet, you could stake perhaps £32 per point. A sell bet is placed at the lower price of the quote, in this case 37.04. Even though this is a futures style bet, it is important to remember that you can always close the bet at any time, whether it is because you have reached the amount of profit that you sought, or because you cannot sustain any more losses.

Suppose your bet works out, and the quote goes down to 23.54 – 23.99. Your bet was placed at the selling price of 37.04. Your bet closed at the buying price of 23.99. 37.04 minus 23.99 is 13.05, and this is the number of points you gained with your short bet. As you staked £32 per point, you have won 13.05 times £32 which is £417.60.

You must also be prepared for a number of your bets to lose, as the financial markets are difficult to predict. Say the price went up to 42.44 – 42.89, and you decided you had to cut your losses. Your bet would close at 42.89, so taking away the starting price of 37.04 you would have lost 5.85 points. For a stake of £13 per point, this works out to a loss of £187.20.

Should you decide to place a stop loss order when you take out the bet, you may find that your losses are less as the losing bet will be closed as soon as the price reaches a limit that you set. In this case the bet might close at 39.74 – 40.19. 40.19 less 37.04, the opening price, is 3.15 points, and multiplying it by your stake of £32 results in a loss of £100.80.