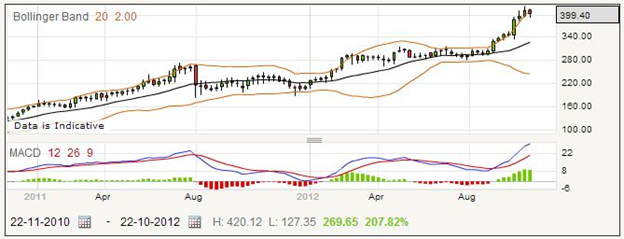

Sports Direct International is the largest sports retailer in the UK, and has other foreign interests in the market sector. From a spread betting standpoint, you can see that the weekly price chart below is not very volatile, though it appears somewhat unpredictable.

The company was originally founded in 1982, and the founder, Mike Ashley, a former squash coach, still holds the majority of the shares. The company went public in 2007 on the London Stock Exchange. Over the years, the Group has expanded by acquisition of many well-known names. It bought Lillywhites, the London-based sports shop, in 2002, and in 2004 got hold of the Dunlop, Slazenger, and Carlton brands. Other famous acquisitions include Kangol, Karrimor, and Lonsdale, the boxing brand.

The company now employs about 11,000 people in nearly 500 stores in the UK, and has operations in Ireland, France, Belgium, Luxembourg, Poland, Portugal, Cyprus, and Slovenia. It is also expanded into franchising in the Middle East and South Africa.

One possible reason for the lack of volatility in the price is the number of shares still held by Ashley. Only just over a quarter of the shares are publicly traded, which means the market is not as active as it would otherwise be. The indications are that Ashley still has strong control and a large agenda for the company.

Within the constraints of its type of performance, you can see that the price is responding to the Bollinger Bands as might be predicted. The narrowing of the bands at the beginning of 2012 and in August 2012 was followed in each case by a larger move, as often happens. The MacDee has been tracking these moves, but appears to be lagging too far behind to be of much use for a trading indicator, at least on this time scale.

Sports Direct International Rolling Daily: How to Spread Bet on Sports Direct International shares?

You may be considering that Sports Direct International is worth a long spread bet, wagering that the price will go up in the short term, and decide that you will stake £8 per point. The current quote for a rolling daily bet is selling price 404.99, buying price 407.02, so your bet will go on at 407.02.

If the current trend continues, your bet may turn out to be a winner and you could decide to cash it in and collect your profits when the quote goes up to 453.62 – 456.65. As it is a long bet, it closes on the selling price which is 453.62. To work out how much you have won, you must take the difference between the starting and finishing prices, 453.62 minus 407.02, which is 46.60 points, and for your chosen £8 stake that works out to £372.80.

However, you will know if you have done much spread betting that you will often have a losing bet, and you need to close the bet for a loss to avoid losing any more. Suppose the price went down to 375.14 – 378.17, and you decided to cut your losses. The bet was placed at 407.02, and it closed at 375.14. The difference in this case is 31.88 points, and multiplying it by £8 you find you have sustained a loss of £255.04.

Many traders and spread betters decide to use a stop loss order to cover times when they cannot watch the markets. With a stoploss order, your spread betting provider will close a losing bet for you when it reaches a certain level that you set. In this case, you might find that a stoploss order would close your bet at a price of 388.53 – 391.56. 407.02 less 388.53 is 18.49 points, so your loss is £147.92.

Sports Direct International Futures Based Spread Bet

If you want to take a longer-term view of the share price of Sports Direct International, you may choose to place a bet on the futures style prices. The current quote for a far quarter spread bet is 406.18 – 411.09. If you have a bearish attitude towards this company, you could place a short bet, selling at £7.50 per point at 406.18.

As an example, suppose that the price goes down and you decide to close your spread bet when it reaches 342.69 – 347.32. Your bet was placed at 406.18, and you closed it at 347.32, the buying price. 406.18 minus 347.32 is 58.86, so you have gained 58.86 points with your bet. With a stake of £7.50 per point, your winnings would be £441.45.

As your bet might lose, you can work out how much that would cost you. Say the price went up 454.91 – 457.55, and you close your bet to cut your losses. The starting price was 406.18, as before, and the closing price this time was 457.55. 457.55-406.18 is 51.37 points. For your chosen size of wager, this works out to a loss of £385.28.

Perhaps you are concerned to limit your losses, and you cannot find time to watch the market all day long. In that case, you should probably place a stop loss order when you open the bet, as then your spread betting company will close the losing bet for you when it reaches a level you set. In this case, you might find that a stoploss order would close the trade when the price went up to 438.24 – 442.36. The bet closes at the buying price of 442.36, up from a starting price of 406.18. The difference between these is 36.18 points. 36.18 times £7.50 is £271.35, a reduced loss using the stoploss order.