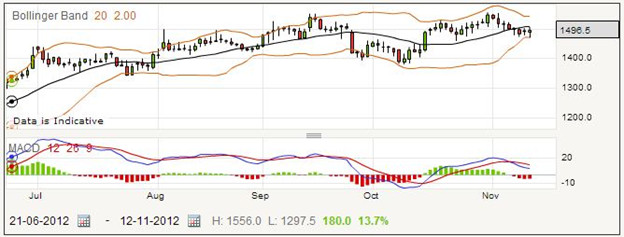

The Berkeley Group is a house building company based in the Home Counties. The chart shows plenty of opportunity for spread betting, with moves both up and down over the last year. Given the recent history of the housing market, you should look forward to good volatility for some time to come.

This is a daily chart, showing some marked moves indicated by the MACD.

The company was founded in 1976 as Berkeley Homes, primarily to build executive housing on small sites. It floated on the unlisted securities market in 1984, which time it was still building less than 100 homes a year. After flotation, it expanded to cover the Midlands and East Anglia, as well as building properties in central London. The expansion was so successful, that it increased its output to 600 homes a year by 1988.

For a couple of years, the company was content to breakeven and maintain its position, and with the cash it had generated it started acquisition of more land and of the Manchester-based Crosby Homes. The 90s were a focus on urban regeneration across the country, but the 2000s saw a return to London and large-scale urban development.

The current emphasis is on houses and flats in London, with a sprinkling of commercial and student accommodation. The company claims to have a rational investment structure, recognizing that house building comes in cycles, and avoiding over leveraging its assets.

From a trading perspective, you can see that the daily candles have a reasonable range between high and low levels, and that there had been several opportunities to follow a trend. When picking a time to enter the market, you should try to place your bet when the price is near to its expected current extreme position. For instance if you are taking a long position, you would examine the typical daily range and not bet until you suspected the price was at its lowest level. That way you will not only achieve the gains of the trend in general, but pick up most of the daily range.

Berkeley Group Holdings Rolling Daily

As always with a volatile share price, you should be careful to size your bets appropriately bearing in mind the size of your account and the possible price fluctuations. The current price for a rolling daily bet on the Berkeley Group is 1493.3 – 1500.7. If you think the price is going down, you could take out a short position selling at 1493.3 for £1.50 per point.

Suppose you are correct, and the price drops in the next few days to 1387.2 – 1394.8. If you close the bet now, it would close at 1394.8, the buying price, as it was a short bet. That means your starting price was 1493.3, and your buying price was 1394.8. The difference between these is 98.5 points, so you have won £1.50 times 98.5, which is £147.75.

On your other hand, the price might go up after you place your spreadbet, and you would need to close your trade quickly to minimize your loss. Suppose by the time you noticed it had reached a level of 1573.6 – 1581.0. Your losing bet would close at 1581.0. 1581.0-1493.3 is 87.7 points. For your chosen size of stake, this would be a loss of £131.55.

What many spread betters decide to do is to place a stop loss order when they open a new bet. This requires the spread betting provider to close the trade if the price goes too far in the wrong direction, and it keeps down the amount of loss they suffer on any particular trade, whether or not they can be watching the market. In this case a stop loss order might have closed the bet earlier, at a price of 1552.1 – 1559.5. Working out the calculation now, 1559.5 minus 1493.3 is 66.2 points, which amounts to a loss of £99.30 for this spread bet.

Bellway Futures Style Bet

You should be careful to perform detailed technical analysis on every bet that you place. Even though this trading is called spread betting, it should not be viewed as gambling, and you can minimize the amount of chance by careful selection of your bets. The far quarter futures style bet is currently priced at 1043.6 – 1055.6. Say you decide to place a short bet for £6 per point.

For the sake of example, assume firstly that you have a winning position, with the price going down to 946.1 – 958.1. Your bet was placed at the selling price of 1043.6, and it closes at the buying price of 958.1. 1043.6 minus 958.1 is 85.5 points, the amount that your bet has gained. Multiplying by the stake of £6 per point, this works out to a profit of £513.

With the financial markets, you can never be sure which way the price will go, and a winning strategy is one which minimizes your losses while maximizing your gains. That means you need to close a losing position quickly, as soon as you realize it is not going to work out. Perhaps the price could go up to 1082.6 – 1094.6, and you decide to cut your losses. With an opening price of 1043.6, your bet closed at 1094.6 for a loss of 51 points. Multiplying this by £6, your total loss in this bet would be £306.

Many spread traders use the stop loss order to protect themselves from large losses. Even if they cannot watch the markets, their spread betting company will close a losing bet for them once a certain price level is reached. In this case, a stop loss order might have closed your losing trade at 1063.1 – 1075.1. The closing price would be 1075.1, so taking away the opening price of 1043.6 you would have lost 31.5 points. For your chosen size of wager, this amounts to £189 lost.